Use case – Insurance

Effective customer insight using open banking

05/09/2023

Use case – Sharing Economy

19/04/2024Use Case - Insurance

Over the last few years, the insurance sector has faced significant technological challenges. Most sales were based on direct contact with the customer. COVID-19 pandemic has significantly verified this approach and proved the need to switch to a remote model when concluding contracts with clients.

Challenge:

Switching to a remote model of concluding contracts with customers requires ensuring the appropriate technology enabling the fulfilment of all formal requirements for concluding such a contract and ensuring maximum security for customer data.

Additionally, in the identity verification process, it is important to quickly check the credibility of the data declared by the client, both individual and entire companies, along with checking individual members of the management board.

Solution:

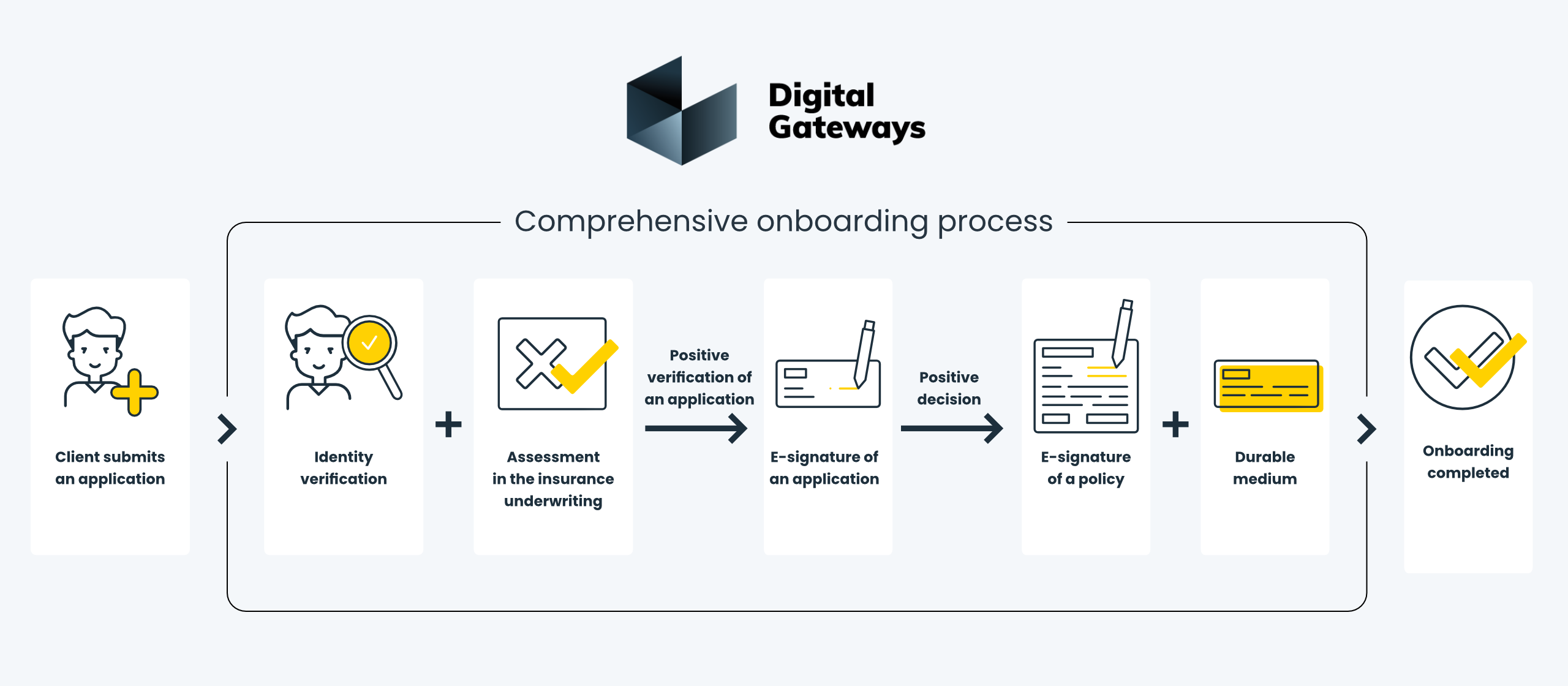

- Identity verification & customer assessment in insurance underwriting - Digital Gateways provides remote customer verification in the insurance policy application process through a full identity gateway - biometrics and video verification, EID, MojeID, mObywatel - and customer assessment in the insurance underwriting, which can be automated thanks to cooperation with AIS Gateway by using open banking data. The use of data in open banking insurance underwriting may become a major innovation on the market and a basis for creating new marketing campaigns in up-sell and cross-sell.

- Electronic signature - if the verification of an application is positive, the application can be signed remotely, and then, after a positive decision, the insurance policy can be signed from anywhere, safely and in accordance with legal requirements.

- Durable medium - Digital Gateways also provides a digital durable medium thanks to cooperation with KIR - a tool that ensures documents are stored in an unchanged form and ensures their availability through the use of blockchain technology. Thanks to this, customers have access to their policy at any time - using the insurer's website or in the e-mail provided to the agent.

Thanks to the full identity verification process, the introduction of an e-signature and a durable medium, Digital Gateways enables fully remote conclusion of insurance contracts - from submitting the application, through signing the contract, to making the application and policy available on a durable medium.