Digital identity wallet – European Union project and commercial solutions

Technology that is changing the B2B sector – digital customer onboarding

03/08/2023Table of content

- The European community makes everyday life easier

- Mutual recognition of documents within the EU

- Digital identity wallet

- Extension of the epidemiological certificate concept

- Digital identity is widely used in business

- In Poland, digital identity has been popularised by the financial sector

- Commercial wallets or administrative solutions

The European community makes everyday life easier

Often when we say 'European Union', we forget how far we are from true unification on our continent. The individual countries of the Union still differ in many important matters, including national regulations, different languages, customs or even money, because we cannot pay in euros everywhere.

Although diversity is a value in itself, there is no denying the fact that, in certain areas, the standardisation of processes and the harmonisation of regulations have made our everyday lives much easier. Thanks to a common Europe, our lives are easier, just think of trouble-free travel within the Schengen area, cheap telephone calls because they are the same price, a driving licence or an identity document recognised in every country.

Mutual recognition of documents within the EU

It is the mutual recognition of documents issued in the member states that is one of the most important factors facilitating the everyday life of citizens of the member states in a united Europe. It is not surprising, therefore, that with the advent of electronic documents, such as digital identity cards, efforts have begun to make them subject to common standards within the EU and to have them respected in each country. Ultimately, any document issued in digital form in any country of the union should be automatically recognised across the continent.

Achieving this ambitious goal would significantly:

- make it easier to speed up all business and official matters,

- simplify citizens' lives,

- reduce the administrative costs currently associated with handling traditional, labour-intensive documentation.

Digital identity wallet

A leading initiative in this area is the European Digital Identity Wallet programme. It is intended to facilitate the use of a variety of digital documents, using the well-known and user-accepted idea of a digital wallet. Its main function is to be able to aggregate official documents, especially those requiring proof of identity.

From the user's point of view, this function is nothing more than the ability to 'insert' a digital document (e.g. an identity card or passport) into a mobile application. Analogous to this are digital payment wallets, which can now store multiple payment cards in digital form, or apps that store airline tickets, receipts or discount coupons.

Extension of the epidemiological certificate concept

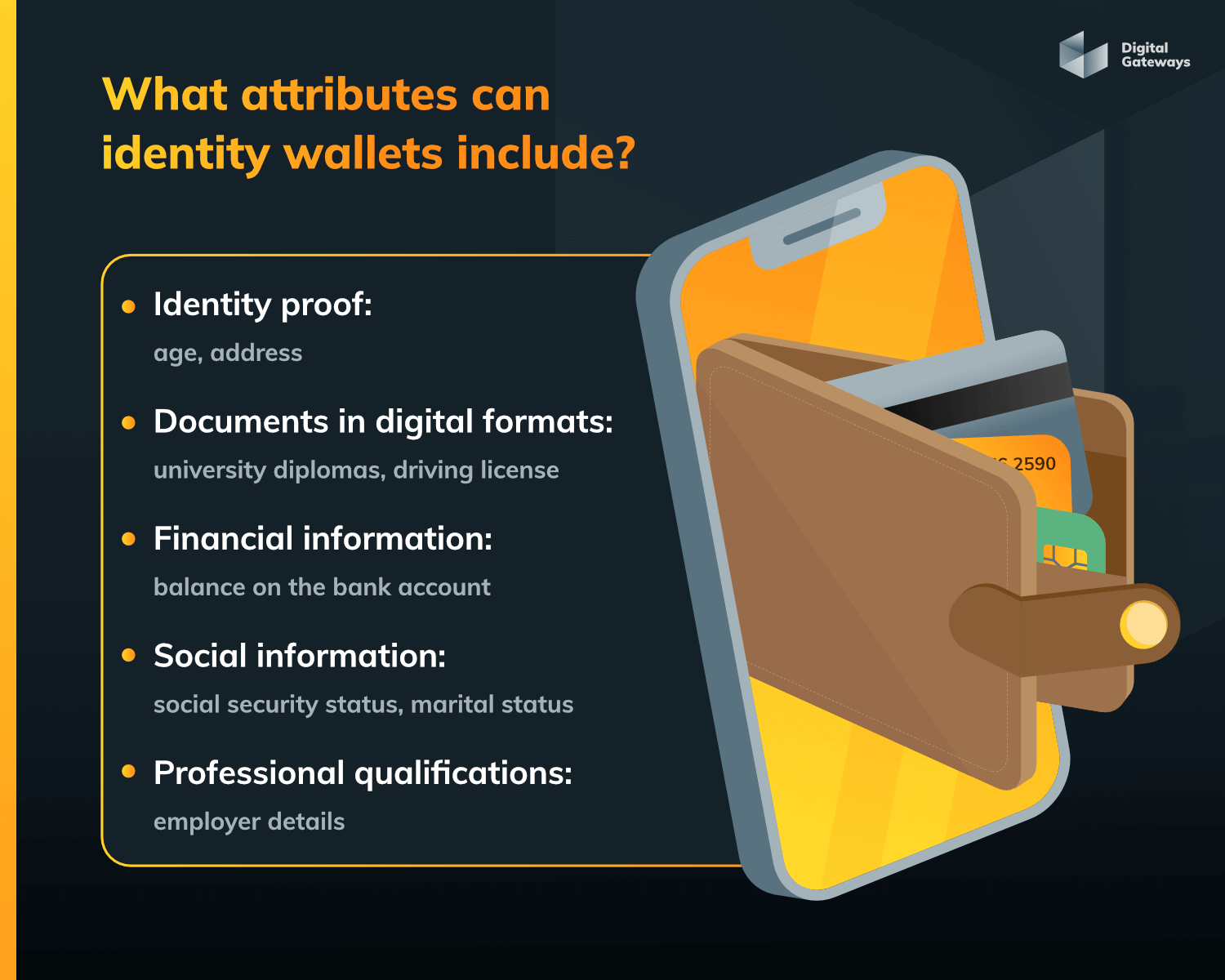

The first mass test of pan-European digital documents issued to individuals was the so-called epidemiological passports issued by individual countries during coronavirus outbreaks. They proved that such digital certificates are convenient to use and can effectively fulfil the tasks set for them. Such identity wallets can be used to confirm information such as: age, address, marital status, social security status.

They can also store in digital form any documents such as:driver's licence, university diplomas, professional qualifications, employer data, or financial information such as a bank account balance certificate.

Digital identity is widely used in business

With the launch of the digital identity wallet project, the European Union is demonstrating its conviction that digital identity is a future-proof, convenient and secure solution. This is undoubtedly based on observations of the use of digital identity to date in business, the financial sector, in remote contracting or confirming the reliability of customers, for example when renting flats or cars.

In individual member states, sector-specific digital identity solutions for both individual and business customers are widely used and generally accepted.

In Poland, digital identity has been popularised by the financial sector.

In Poland, one of the most commonly used digital customer profiles is that stored in financial institutions, especially banks. Banks are obliged to carefully verify the identity of their customers. The data obtained in this way is available in electronic form to other authorised institutions. For example, the banks' systems are used by government administrations in the form of a trusted profile.

The data can also be used by other banks, lending companies and payment institutions through open banking. This is done in a way that complies with European regulations, as in other countries. Providers of these solutions, such as Digital Gateways, offer these solutions to verify the customer's identity,registration and financial situation, in the form of a digital certificate of income confirmation. Based on European regulations, these types of solutions are already ready for use in the Union's digital wallet.

Commercial wallets or administrative solutions

The rapid development of commercial digital identities, such as the Apple Wallet installed on every iPhone or the phone-independent Digital ID Wallet from Thales, gives the impression that the future of digital wallets belongs to them. However, solutions introduced by administrative regulations, developed in EU offices, will certainly prove successful in applications requiring uniform acceptance in all EU countries. In such cases, they will prove more effective than those built and promoted by business entities. We should certainly expect the coexistence of national portfolios, such as the Polish mObywatel application, and commercial portfolios. Given the dynamic development of both types of digital identity wallets, it should soon be clear which of them will prove more popular and widely used.